There

will be 11 separate initiatives on the California ballot on Tuesday, as

any California voter who’s been watching TV knows. Some of the

advertising on these initiatives is absurd. Most of it from both sides

of the aisle focuses on a single point – sometimes a misleading one – as

if the voters are morons who can’t string more than one thought

together. Herewith, a slightly more in-depth treatment. (Prop. 30 is the only one that runs long.)

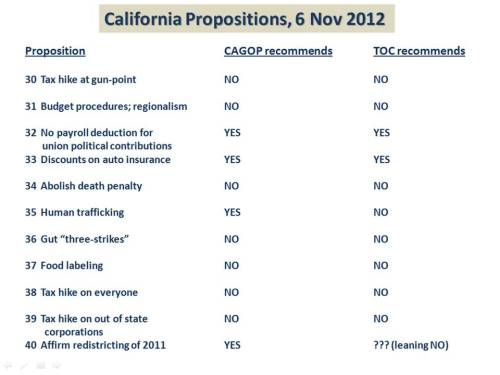

Bonus features: (a) a printable crib sheet to remind you which way you want to vote on each measure. (b) Link to the full texts of the propositions at the California Secretary of State website.

Proposition 30. Better known as “Hand over the cash or we kill the schools,” Prop. 30 proposes a quarter-cent increase in the state sales tax (currently at 7.25%) and a one-percent increase in each of four new brackets on the incomes of earners over $250,000. (Very clear summary of its provisions here; the new top tax rates will range from 10.3% to 13.3%.) Jerry Brown projects that Prop. 30 will bring in an additional $6 billion in revenue each year.

This, of course, is risible: raising taxes on consumption and high earners has never brought in the projected revenue for California, because people behave differently when the rules change. In the ongoing nationwide recession, California has already lost 32% of the earners above $500,000 who filed in 2007. Some left the state, as part of the approximately 2,000 tax filers of all incomes who have left each week over the last 5 years; others saw their incomes decline. The Tax Foundation pointed out in July the volatility of the highest-earner incomes, and the folly of state policies that ensure more than 50% of revenues derive from taxes on them.

The biggest problem in California’s fiscal endeavors, of course, is state spending. As the Tax Foundation study observes, Governor Brown has not cut but increased it, by 7% with his latest budget. The publicity campaign for Prop. 30 has been all about “not cutting funds for schools,” but, of course, Brown and the Democratic legislature could cut a lot of other things before they had to cut school funding. They’re holding the schools hostage.

They’re also holding public safety hostage. It’s in Prop. 30, but no one is talking about it in the TV ads. In the 2011 Public Safety Realignment Act, which shifted important responsibilities for public safety – e.g., administration of jails and parole programs – from the state to county and city governments, the state promised to provide funding to the local governments to support these responsibilities. This whole process increases the vulnerability of local governments – and citizens – to pressure from Sacramento, and was a bad idea from the start. Prop. 30 demonstrates just how bad it is, by tying the funding of state support for the local governments to the passage of Prop. 30.

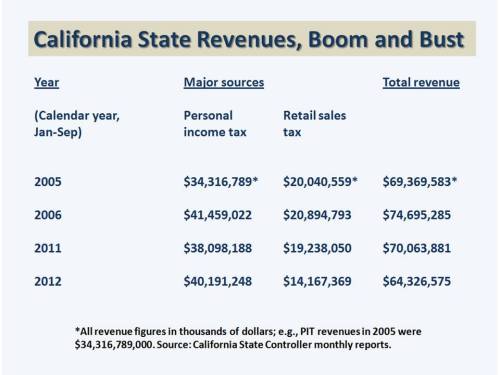

It’s naked extortion: pony up, taxpayers, or we’ll cut funds to schools and public safety. California governments have been doing it for at least two decades now, and it’s getting old. The spending priorities for the Democrats in Sacramento are the problem. Schools and public safety should never be first on the chopping block. The state of California took in $64,326,575,000 in revenues from January to September 2012, according to the State Controller. That’s more than enough to pay for schools and public safety.

Of course, this year’s $64-odd billion is down from the same period in 2011, when the state took in $70,063,881,000. Revenues in the first 9 calendar months dropped a little over 8% between 2011 and 2012. It’s worth taking a look at the same period in 2005 and 2006 – the boom years – to see where the shortfalls come from (Figure 1).

The California “Millionaires’ Tax” – Proposition 63, approved in 2004, which added a percentage point to the top rate on those making over $1 million – took effect in fiscal 2005. (The pretext for the tax was paying for mental-health services.) Millionaire taxpayers have been paying a premium since then, and it hasn’t induced either the rich or the poor to consume more. Retail sales tax revenues for the state are down more than $6 billion from 2006.

This is undoubtedly due in large part to the state’s declining labor force participation rate, which in September 2011 was down to 55.4%, the lowest since 1976. And that figure is due in large part to the catastrophic decline in business start-ups in California, which dropped from more than 12,500 start-ups in 2009 to a loss of 4,600 businesses in 2010 – that’s net negative business formation – causing California to plummet to 50th overall.

It’s also worth pointing out that the Mental Health Services tax is only on millionaires. A much-touted recent study found that there wasn’t a net flight of millionaires from California after the tax was imposed. There was, however, an increase in the net out-migration rate of those making between $500,000 and $1 million a year. The increase was particularly marked for those earning between about $550,000 and $613,000 – in other words, tomorrow’s millionaires, but people with mortgages and other loans to pay off today, and children to raise and put through college. If Prop. 30 passes, they will have gotten out in time.

It’s California policies – absurdly burdensome business regulation, “climate change” regulation, health care mandates – that are killing businesses in the state and leaving the middle class, year after year, with less discretionary income. What California needs is not more taxes on “the rich” (who, under Prop. 30. are those making $250,000 a year), or a higher sales tax on everyone. What California needs is policies that don’t repress economic activity. The policies that do repress economic activity have their biggest negative impact on the middle and lower-income working class, by inhibiting job formation and making everything cost more, from food to energy to health care.

Until the Democrats in Sacramento are willing to change state policies, vote NO on measures that would raise tax rates. Don’t keep sending them more money to pay for the same bad policies with.

NO on Proposition 30

Proposition 31. For those of you who thought California already had a two-year budget cycle, Prop. 31 may come as a surprise, since it proposes officially instituting one. But there’s more to it. Most commentators on the left and the right think it has some good features, but it’s just got too many features, and would end up being a mess to try to enforce or live by. Tom McClintock calls it “Rotting mackerel by moonlight.”

I oppose it because it outlines procedures for “local communities,” which seek to affect the budget process in Sacramento, to adopt “Strategic Action Plans” for achieving such social-engineering codeword goals as “community equity.” As McClintock implies, this is a step on the way to the kind of “regionalism” Stanley Kurtz has called out as a key goal of radical leftists, the United Nations, and Obama’s close associates.

Regionalism, by their lights, is a means of organizing tax revenues at the “regional” level – above cities and even counties – in order to shift money by fiat from the suburbs to the urban cores. Ultimately, the goal is to prevent the formation or even maintenance of family-oriented suburbs. Regionalism gets a big shot in the arm if activists can get funding from the federal or state government. Their plans, with money behind them from higher echelons of government, become faits accomplis.

Prop. 31 is about the California state budget. Don’t create a privileged entrée into the state budget for regionalist “Strategic Action Plans.” Once the state and groups of activists have dollar leverage over the “region” of which you may be a part, you will lose your voice in your community’s future.

(Must-reading on the topic of regionalism: Kurtz’s Spreading the Wealth: How Obama is Robbing the Suburbs to Pay for the Cities. It’s short and a very quick read)

NO on Proposition 31

Proposition 32. If you listened to its opponents, you would think Prop. 32 was about who could spend money on politics in California. Wrong. The actual big deal in Prop. 32 is outlawing the payroll deduction of political contributions from union members. Union members can’t be forced to contribute to their unions’ political causes or candidates under Prop. 32. It’s worth supporting just for that element, but it also prohibits corporations from doing the same thing. Moreover, it prohibits corporations as well as unions from donating directly to individual candidates. These are good measures. They won’t stop unions or corporations from donating to PACs, and they won’t stop PACs from flooding the California infosphere with appeals. But then, that would be unconstitutional.

YES on Proposition 32

Proposition 33. I recommend making up your own mind on this one. California law currently prevents auto insurers from giving new clients a continuous-coverage discount if the new clients have maintained continuous coverage with another insurer. Seems pretty stupid. Prop. 33 allows insurers to give those discounts when they get new clients. It’s really hard for me to get excited about this, since all Prop. 33 does is make another law to fix a stupid law that should never have existed in the first place. Why is the state of California even making laws about this stuff?

But since it is, and if your fingers aren’t too tired by the time you get to Prop. 33 on the ballot, vote:

YES on Proposition 33

Proposition 34. This measure would abolish the death penalty for first-degree (capital) murder in California. You know the arguments.

NO on Proposition 34

Proposition 35. Proposition 35 expands the state’s current, inadequate definition of “human trafficking” and includes stiffer punishments. These are good things. Tom McClintock endorses Prop. 35, but points out that the measure has some problematic aspects which could encourage “prosecutorial abuse.” Presumably, those aspects would be taken up in the courts if defendants thought they were harmed by them.

It’s a real question whether one ought to vote for a proposition because its intention is good, even though parts of it might be tossed out by the courts. We report, you decide. I’m bucking the GOP tide on this one. The enforceability and meaning of law are too important; it’s a poor use of our rights and obligations as citizens to pass laws that could invite prosecutorial abuse, and might well – for legitimate reasons – not survive a court review.

I believe strongly that we need to crack down on human trafficking, but I’m not sure a ballot measure that comes with constitutional-rights questions is the right way to do it. This one is made for the legislators in Sacramento. We should put pressure on them, but vote:

NO on Proposition 35

Proposition 36. This measure would gut California’s “three-strikes” law on criminal offenders. You know the arguments.

NO on Proposition 36

Proposition 37. One of the silliest, most poorly crafted measures to come down the pike in a long time. As one ad points out, it would in some case require more stringent labeling for dog food than for people food.

The purpose of the law is to enable activists and regulators to order food producers to label their products “GENETICALLY ENGINEERED” – even though there’s not necessarily any set definition for what qualifies as “genetically engineered,” from one food type to another. As opponents point out, there’s nothing wrong with foods that have benefited from biotechnology anyway – many of which can be cultivated, because of biotech advances, without the use of pesticides.

Prop. 37 would give activists a foot in the door to keep shifting the goal line on food producers and food labeling. It will cost you more every time they change definitions or criteria. Don’t let it start. Just say no.

NO on Proposition 37

Proposition 38. If increasing tax rates on those earning above $250,000 is good, increasing tax rates on those earning above $7,316 per year must be better, right? After all, it’s to pay for schools.

Yes, Prop. 38 is serious. And it really goes on a tax hunt all the way down to incomes of $7,316. Your federal tax rate is going up in January, and the crafters of Prop. 38 suggest you should agree to pay higher state income taxes as well.

Now, don’t get me wrong. I’m a fan of paying for our proposed spending. But California is in a deep economic funk, and millions of households are hurting. CUT THE SPENDING FIRST, and don’t take it out of schools. Eliminate whole state departments, and get rid of at least 80% of the state’s regulatory code.

NO on Proposition 38

Proposition 39. This measure hikes the tax on out-of-state corporations that don’t have employees or facilities in California (but sell or do business here). It requires these corporations to calculate their California tax liability based on the percentage of their revenues gained in California, rather than by an older method that resulted in a lower tax owed to the state.

Bigger companies will be able to absorb these tax increases. although the result will be raising prices for consumers. Prop. 39 will hurt a lot of mid-size companies in all industries, from agriculture to consumer products. It will force their prices up too. Some companies will have to decide to stop doing business in California.

The plan for the increased revenue – laughably touted as $1 billion a year (take it to the bank; it won’t be that much) – is to “create 40,000 green jobs” with it.

If you’re not rolling on the floor laughing out loud too hard, please vote:

NO on Proposition 39

Proposition 40. This one comes with a convoluted and ridiculous tale about the citizen committee that created new districts in 2011 for the state senate and assembly, and Republican senators who didn’t like some of the new districts. The state Republicans got Prop. 40 on the ballot as a referendum on the new districts, proposing a “No” vote which would mean the redistricting process would have to be revisited.

The state Republicans have now sorted themselves out – see excruciating detail here – and recommend voting “Yes” on Prop. 40. In other words, vote to affirm the despised new districts, rather than rejecting them.

The new districts are, in fact, generally bad for Republicans, although some – substantially fewer – are bad for Democrats as well. Pro Publica, by no means a right-wing non-profit, found that the Democrats in Sacramento had “fooled” the California Redistricting Commission during its deliberations in 2011, ensuring a thoroughly partisan outcome. The Commission, for its part, decided not to even consider how redistricting would affect the political parties, which meant that briefings from Democrats went unchallenged in that regard. Republicans, according to the Pro Publica investigation, hardly even bestirred themselves, making little effort to affect the proceedings.

But disgruntled Republicans did decide to push for Prop. 40 after the redistricting effort came out unfavorably. Then, sometime this year, they backtracked and now urge voters to endorse Prop. 40.

I’m of two minds myself. I don’t like the new districts. I can’t endorse them as having been drawn fairly, because I don’t think they were. On the other hand, what’s the point of voting “No” on Prop. 40? Decide for yourself. If we had a “Proposition 41: Be it resolved, the California state Republicans behaved like idiots during the redistricting process,” I could give that one a resounding “YES!” I haven’t decided what to do yet on Prop. 40, however. There’s always the option of not voting on it.

The texts of the propositions are all in this document provided at the California Secretary of State website.

To print the crib sheet, click on it to view it as a separate image, then print as usual from your computer.

If you’re voting on judges this year, Craig Huey, as always, has The Guide.

J.E. Dyer’s articles have appeared at Hot Air’s Green Room, Commentary’s “contentions,” Patheos, and The Weekly Standard online.

Bonus features: (a) a printable crib sheet to remind you which way you want to vote on each measure. (b) Link to the full texts of the propositions at the California Secretary of State website.

Proposition 30. Better known as “Hand over the cash or we kill the schools,” Prop. 30 proposes a quarter-cent increase in the state sales tax (currently at 7.25%) and a one-percent increase in each of four new brackets on the incomes of earners over $250,000. (Very clear summary of its provisions here; the new top tax rates will range from 10.3% to 13.3%.) Jerry Brown projects that Prop. 30 will bring in an additional $6 billion in revenue each year.

This, of course, is risible: raising taxes on consumption and high earners has never brought in the projected revenue for California, because people behave differently when the rules change. In the ongoing nationwide recession, California has already lost 32% of the earners above $500,000 who filed in 2007. Some left the state, as part of the approximately 2,000 tax filers of all incomes who have left each week over the last 5 years; others saw their incomes decline. The Tax Foundation pointed out in July the volatility of the highest-earner incomes, and the folly of state policies that ensure more than 50% of revenues derive from taxes on them.

The biggest problem in California’s fiscal endeavors, of course, is state spending. As the Tax Foundation study observes, Governor Brown has not cut but increased it, by 7% with his latest budget. The publicity campaign for Prop. 30 has been all about “not cutting funds for schools,” but, of course, Brown and the Democratic legislature could cut a lot of other things before they had to cut school funding. They’re holding the schools hostage.

They’re also holding public safety hostage. It’s in Prop. 30, but no one is talking about it in the TV ads. In the 2011 Public Safety Realignment Act, which shifted important responsibilities for public safety – e.g., administration of jails and parole programs – from the state to county and city governments, the state promised to provide funding to the local governments to support these responsibilities. This whole process increases the vulnerability of local governments – and citizens – to pressure from Sacramento, and was a bad idea from the start. Prop. 30 demonstrates just how bad it is, by tying the funding of state support for the local governments to the passage of Prop. 30.

It’s naked extortion: pony up, taxpayers, or we’ll cut funds to schools and public safety. California governments have been doing it for at least two decades now, and it’s getting old. The spending priorities for the Democrats in Sacramento are the problem. Schools and public safety should never be first on the chopping block. The state of California took in $64,326,575,000 in revenues from January to September 2012, according to the State Controller. That’s more than enough to pay for schools and public safety.

Of course, this year’s $64-odd billion is down from the same period in 2011, when the state took in $70,063,881,000. Revenues in the first 9 calendar months dropped a little over 8% between 2011 and 2012. It’s worth taking a look at the same period in 2005 and 2006 – the boom years – to see where the shortfalls come from (Figure 1).

The California “Millionaires’ Tax” – Proposition 63, approved in 2004, which added a percentage point to the top rate on those making over $1 million – took effect in fiscal 2005. (The pretext for the tax was paying for mental-health services.) Millionaire taxpayers have been paying a premium since then, and it hasn’t induced either the rich or the poor to consume more. Retail sales tax revenues for the state are down more than $6 billion from 2006.

This is undoubtedly due in large part to the state’s declining labor force participation rate, which in September 2011 was down to 55.4%, the lowest since 1976. And that figure is due in large part to the catastrophic decline in business start-ups in California, which dropped from more than 12,500 start-ups in 2009 to a loss of 4,600 businesses in 2010 – that’s net negative business formation – causing California to plummet to 50th overall.

It’s also worth pointing out that the Mental Health Services tax is only on millionaires. A much-touted recent study found that there wasn’t a net flight of millionaires from California after the tax was imposed. There was, however, an increase in the net out-migration rate of those making between $500,000 and $1 million a year. The increase was particularly marked for those earning between about $550,000 and $613,000 – in other words, tomorrow’s millionaires, but people with mortgages and other loans to pay off today, and children to raise and put through college. If Prop. 30 passes, they will have gotten out in time.

It’s California policies – absurdly burdensome business regulation, “climate change” regulation, health care mandates – that are killing businesses in the state and leaving the middle class, year after year, with less discretionary income. What California needs is not more taxes on “the rich” (who, under Prop. 30. are those making $250,000 a year), or a higher sales tax on everyone. What California needs is policies that don’t repress economic activity. The policies that do repress economic activity have their biggest negative impact on the middle and lower-income working class, by inhibiting job formation and making everything cost more, from food to energy to health care.

Until the Democrats in Sacramento are willing to change state policies, vote NO on measures that would raise tax rates. Don’t keep sending them more money to pay for the same bad policies with.

NO on Proposition 30

Proposition 31. For those of you who thought California already had a two-year budget cycle, Prop. 31 may come as a surprise, since it proposes officially instituting one. But there’s more to it. Most commentators on the left and the right think it has some good features, but it’s just got too many features, and would end up being a mess to try to enforce or live by. Tom McClintock calls it “Rotting mackerel by moonlight.”

I oppose it because it outlines procedures for “local communities,” which seek to affect the budget process in Sacramento, to adopt “Strategic Action Plans” for achieving such social-engineering codeword goals as “community equity.” As McClintock implies, this is a step on the way to the kind of “regionalism” Stanley Kurtz has called out as a key goal of radical leftists, the United Nations, and Obama’s close associates.

Regionalism, by their lights, is a means of organizing tax revenues at the “regional” level – above cities and even counties – in order to shift money by fiat from the suburbs to the urban cores. Ultimately, the goal is to prevent the formation or even maintenance of family-oriented suburbs. Regionalism gets a big shot in the arm if activists can get funding from the federal or state government. Their plans, with money behind them from higher echelons of government, become faits accomplis.

Prop. 31 is about the California state budget. Don’t create a privileged entrée into the state budget for regionalist “Strategic Action Plans.” Once the state and groups of activists have dollar leverage over the “region” of which you may be a part, you will lose your voice in your community’s future.

(Must-reading on the topic of regionalism: Kurtz’s Spreading the Wealth: How Obama is Robbing the Suburbs to Pay for the Cities. It’s short and a very quick read)

NO on Proposition 31

Proposition 32. If you listened to its opponents, you would think Prop. 32 was about who could spend money on politics in California. Wrong. The actual big deal in Prop. 32 is outlawing the payroll deduction of political contributions from union members. Union members can’t be forced to contribute to their unions’ political causes or candidates under Prop. 32. It’s worth supporting just for that element, but it also prohibits corporations from doing the same thing. Moreover, it prohibits corporations as well as unions from donating directly to individual candidates. These are good measures. They won’t stop unions or corporations from donating to PACs, and they won’t stop PACs from flooding the California infosphere with appeals. But then, that would be unconstitutional.

YES on Proposition 32

Proposition 33. I recommend making up your own mind on this one. California law currently prevents auto insurers from giving new clients a continuous-coverage discount if the new clients have maintained continuous coverage with another insurer. Seems pretty stupid. Prop. 33 allows insurers to give those discounts when they get new clients. It’s really hard for me to get excited about this, since all Prop. 33 does is make another law to fix a stupid law that should never have existed in the first place. Why is the state of California even making laws about this stuff?

But since it is, and if your fingers aren’t too tired by the time you get to Prop. 33 on the ballot, vote:

YES on Proposition 33

Proposition 34. This measure would abolish the death penalty for first-degree (capital) murder in California. You know the arguments.

NO on Proposition 34

Proposition 35. Proposition 35 expands the state’s current, inadequate definition of “human trafficking” and includes stiffer punishments. These are good things. Tom McClintock endorses Prop. 35, but points out that the measure has some problematic aspects which could encourage “prosecutorial abuse.” Presumably, those aspects would be taken up in the courts if defendants thought they were harmed by them.

It’s a real question whether one ought to vote for a proposition because its intention is good, even though parts of it might be tossed out by the courts. We report, you decide. I’m bucking the GOP tide on this one. The enforceability and meaning of law are too important; it’s a poor use of our rights and obligations as citizens to pass laws that could invite prosecutorial abuse, and might well – for legitimate reasons – not survive a court review.

I believe strongly that we need to crack down on human trafficking, but I’m not sure a ballot measure that comes with constitutional-rights questions is the right way to do it. This one is made for the legislators in Sacramento. We should put pressure on them, but vote:

NO on Proposition 35

Proposition 36. This measure would gut California’s “three-strikes” law on criminal offenders. You know the arguments.

NO on Proposition 36

Proposition 37. One of the silliest, most poorly crafted measures to come down the pike in a long time. As one ad points out, it would in some case require more stringent labeling for dog food than for people food.

The purpose of the law is to enable activists and regulators to order food producers to label their products “GENETICALLY ENGINEERED” – even though there’s not necessarily any set definition for what qualifies as “genetically engineered,” from one food type to another. As opponents point out, there’s nothing wrong with foods that have benefited from biotechnology anyway – many of which can be cultivated, because of biotech advances, without the use of pesticides.

Prop. 37 would give activists a foot in the door to keep shifting the goal line on food producers and food labeling. It will cost you more every time they change definitions or criteria. Don’t let it start. Just say no.

NO on Proposition 37

Proposition 38. If increasing tax rates on those earning above $250,000 is good, increasing tax rates on those earning above $7,316 per year must be better, right? After all, it’s to pay for schools.

Yes, Prop. 38 is serious. And it really goes on a tax hunt all the way down to incomes of $7,316. Your federal tax rate is going up in January, and the crafters of Prop. 38 suggest you should agree to pay higher state income taxes as well.

Now, don’t get me wrong. I’m a fan of paying for our proposed spending. But California is in a deep economic funk, and millions of households are hurting. CUT THE SPENDING FIRST, and don’t take it out of schools. Eliminate whole state departments, and get rid of at least 80% of the state’s regulatory code.

NO on Proposition 38

Proposition 39. This measure hikes the tax on out-of-state corporations that don’t have employees or facilities in California (but sell or do business here). It requires these corporations to calculate their California tax liability based on the percentage of their revenues gained in California, rather than by an older method that resulted in a lower tax owed to the state.

Bigger companies will be able to absorb these tax increases. although the result will be raising prices for consumers. Prop. 39 will hurt a lot of mid-size companies in all industries, from agriculture to consumer products. It will force their prices up too. Some companies will have to decide to stop doing business in California.

The plan for the increased revenue – laughably touted as $1 billion a year (take it to the bank; it won’t be that much) – is to “create 40,000 green jobs” with it.

If you’re not rolling on the floor laughing out loud too hard, please vote:

NO on Proposition 39

Proposition 40. This one comes with a convoluted and ridiculous tale about the citizen committee that created new districts in 2011 for the state senate and assembly, and Republican senators who didn’t like some of the new districts. The state Republicans got Prop. 40 on the ballot as a referendum on the new districts, proposing a “No” vote which would mean the redistricting process would have to be revisited.

The state Republicans have now sorted themselves out – see excruciating detail here – and recommend voting “Yes” on Prop. 40. In other words, vote to affirm the despised new districts, rather than rejecting them.

The new districts are, in fact, generally bad for Republicans, although some – substantially fewer – are bad for Democrats as well. Pro Publica, by no means a right-wing non-profit, found that the Democrats in Sacramento had “fooled” the California Redistricting Commission during its deliberations in 2011, ensuring a thoroughly partisan outcome. The Commission, for its part, decided not to even consider how redistricting would affect the political parties, which meant that briefings from Democrats went unchallenged in that regard. Republicans, according to the Pro Publica investigation, hardly even bestirred themselves, making little effort to affect the proceedings.

But disgruntled Republicans did decide to push for Prop. 40 after the redistricting effort came out unfavorably. Then, sometime this year, they backtracked and now urge voters to endorse Prop. 40.

I’m of two minds myself. I don’t like the new districts. I can’t endorse them as having been drawn fairly, because I don’t think they were. On the other hand, what’s the point of voting “No” on Prop. 40? Decide for yourself. If we had a “Proposition 41: Be it resolved, the California state Republicans behaved like idiots during the redistricting process,” I could give that one a resounding “YES!” I haven’t decided what to do yet on Prop. 40, however. There’s always the option of not voting on it.

The texts of the propositions are all in this document provided at the California Secretary of State website.

To print the crib sheet, click on it to view it as a separate image, then print as usual from your computer.

If you’re voting on judges this year, Craig Huey, as always, has The Guide.

J.E. Dyer’s articles have appeared at Hot Air’s Green Room, Commentary’s “contentions,” Patheos, and The Weekly Standard online.

No comments:

Post a Comment