Americans are waking up today to the worst “case of the Mondays” they’ll have all year: It’s Tax Day.

Most Americans dread Tax Day, and for good reasons. Beyond the huge tab Americans pay to the government, the tax code is so complex that it’s difficult to figure out what we owe to the IRS. This is a pain for taxpayers and a huge drain on the economy.

According to the federal Taxpayer Advocate in its 2012 report, Americans’ cost of complying with today’s complex tax code totaled $168 billion in 2010. That’s almost as large as the impact of the Obama tax hikes in fiscal year 2013, and twice the size of sequestration this year [see chart].

It takes taxpayers 6.1 billion hours—or 51 hours per household—to complete all the required filings. That’s more than six full eight-hour working days per household!

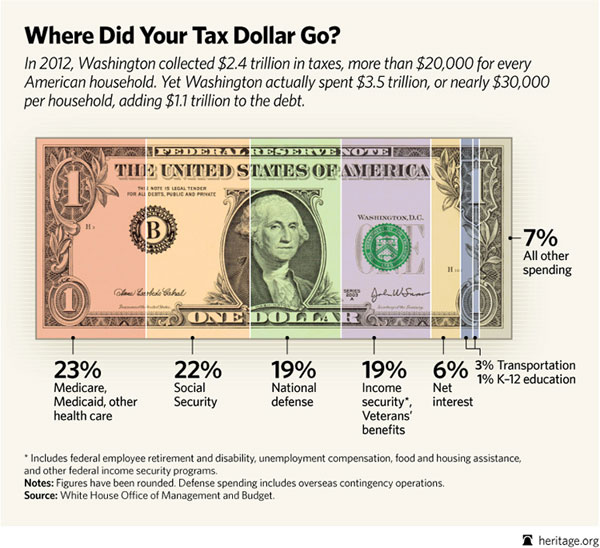

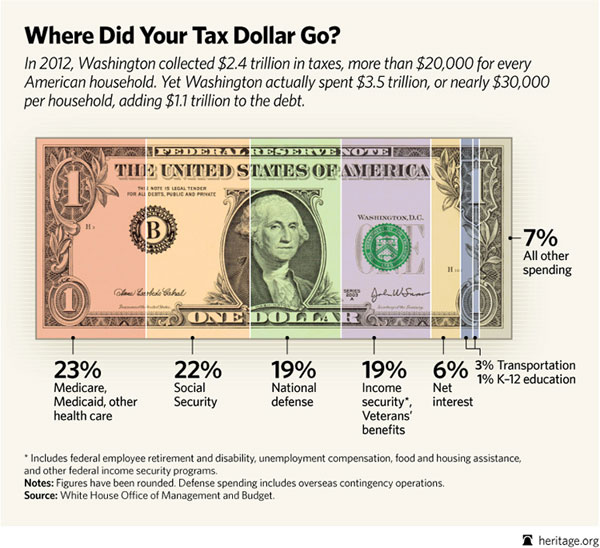

The compliance burden comes on top of the direct financial cost of $3.5 trillion in federal spending. In 2012, Washington collected $20,000 in taxes for every household in America. But Washington spent nearly $30,000 per household.

Tweet this

Americans pay high taxes as it is, and with the 13 tax increases that hit this year, tax revenue is growing beyond its historical average as a share of the economy. But Washington’s deficits continue, because spending keeps going up.

Future Tax Days promise to be even worse because of the tax increases from the fiscal cliff deal and from Obamacare. Taxpayers will start seeing these costs when they do their tax returns next April and in future years.

Too much taxing and spending is bad for the nation. Americans are right to be concerned about how the President and Congress allocate their hard-earned money. As the above infographic shows, 45 percent or almost half of all spending went toward paying for Social Security and health care entitlements. Without reforming these massive and growing programs, Washington will have to borrow increasing amounts of money, piling debt onto younger generations and putting the nation on a dangerous economic course.

Growing government spending threatens current and future taxpayers with higher taxes. Congress should reduce spending and prevent any more tax increases. Congress also needs to reform the tax code so it is less of a burden on the American people.

Tax day is a real drag, but it doesn’t have to be this bad. Learn more at savingthedream.org.

Read the Morning Bell and more en español every day at Heritage Libertad.

Quick Hits:

Most Americans dread Tax Day, and for good reasons. Beyond the huge tab Americans pay to the government, the tax code is so complex that it’s difficult to figure out what we owe to the IRS. This is a pain for taxpayers and a huge drain on the economy.

According to the federal Taxpayer Advocate in its 2012 report, Americans’ cost of complying with today’s complex tax code totaled $168 billion in 2010. That’s almost as large as the impact of the Obama tax hikes in fiscal year 2013, and twice the size of sequestration this year [see chart].

It takes taxpayers 6.1 billion hours—or 51 hours per household—to complete all the required filings. That’s more than six full eight-hour working days per household!

The compliance burden comes on top of the direct financial cost of $3.5 trillion in federal spending. In 2012, Washington collected $20,000 in taxes for every household in America. But Washington spent nearly $30,000 per household.

Tweet this

Americans pay high taxes as it is, and with the 13 tax increases that hit this year, tax revenue is growing beyond its historical average as a share of the economy. But Washington’s deficits continue, because spending keeps going up.

Future Tax Days promise to be even worse because of the tax increases from the fiscal cliff deal and from Obamacare. Taxpayers will start seeing these costs when they do their tax returns next April and in future years.

Too much taxing and spending is bad for the nation. Americans are right to be concerned about how the President and Congress allocate their hard-earned money. As the above infographic shows, 45 percent or almost half of all spending went toward paying for Social Security and health care entitlements. Without reforming these massive and growing programs, Washington will have to borrow increasing amounts of money, piling debt onto younger generations and putting the nation on a dangerous economic course.

Growing government spending threatens current and future taxpayers with higher taxes. Congress should reduce spending and prevent any more tax increases. Congress also needs to reform the tax code so it is less of a burden on the American people.

Tax day is a real drag, but it doesn’t have to be this bad. Learn more at savingthedream.org.

Read the Morning Bell and more en español every day at Heritage Libertad.

Quick Hits:

- Have you heard about the trial of Kermit Gosnell, the abortionist who ran a house of horrors? Heritage President Jim DeMint says it’s up to us to tell this story that the media have been ignoring.

- Senator Marco Rubio (R-FL) made the rounds on the Sunday news shows to discuss the “Gang of Eight” immigration bill that will be released this week.

- Secretary of State John Kerry says he will “reach out” to North Korea.

- Hugo Chavez’s chosen successor won Venezuela’s presidential election by a small percentage yesterday, but the results are in dispute.

- Adam Scott became the first Australian golfer to win the Masters yesterday.

No comments:

Post a Comment