May 22, 2013

Members of Congress called Apple executives to testify on Capitol Hill yesterday. Why? Because the company makes money overseas, and some Senators want to get their hands on the cash.

A Senate subcommittee accused the company of “shifting” profits from the U.S. to other countries and avoiding paying taxes.

But Apple pays its U.S. taxes. Heritage tax expert Curtis Dubay said the earnings aren’t “shifted,” because “it’s not income that’s earned here in the U.S.”

“I can’t go down to the Apple store here in Washington, buy an iPad, and have Apple then ‘shift’ that income abroad,” Dubay said.

The Senators were up in arms about Apple keeping income in Ireland. The issue was the company’s foreign income earned from all those iPhones and iPods that people around the world are buying.

The reason the Senate feigned indignation over an issue that had nothing to do with the U.S. is that some Members want Apple to pay more U.S. tax on all that foreign cash. They want Apple to bring all of that profit back into the U.S. and pay the U.S. corporate tax rate—the world’s highest—on it. But as long as we keep the U.S. rate the highest in the world, Apple and other multinational businesses are going to keep their foreign income abroad.

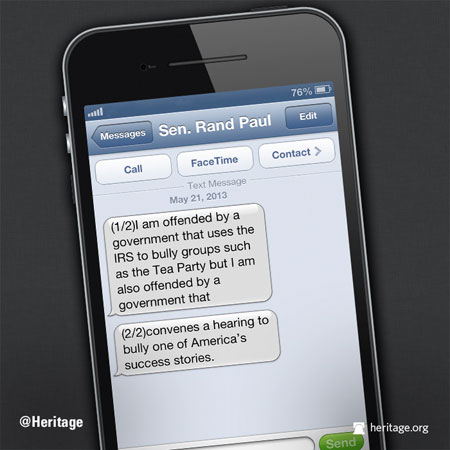

Senator Rand Paul (R-KY) said it was offensive that Senator Carl Levin (D-MI) called in the leaders of a company that is trying to do right by its shareholders. He said:

Instead of Apple executives, we should have brought in here today a giant mirror, okay? So we could look at the reflection of Congress, because this problem is solely and completely created by the awful tax code. If you want to assign blame, the committee needs to look in this mirror and see who created the mess.

Tweet this

Apple—and any other company that does business outside the U.S.—isn’t doing anything illegal to minimize its tax liability. In fact, America’s high corporate tax rate drives companies to do more business overseas.

Not only that, but “we’re the only country that effectively taxes our businesses on income they earn around the world,” Heritage’s Dubay said. “They’re keeping that income abroad because we add that extra layer of tax.”

What to do? Other developed countries have been cutting their corporate tax rates for 20 years. That’s what Congress needs to be looking into, as well as moving away from our “worldwide system” of taxing foreign income—not putting on business-bashing hearings for show. Fortunately, House Ways and Means Committee Chairman Dave Camp (R-MI) has been doing that necessary and difficult work.

As Senator Paul wrote in an op-ed for Rare:

If you want more money to be earned in the United States—make profit welcome here. Until that time arrives, count me out of any government dog and pony shows that badger business.Read the Morning Bell and more en español every day at Heritage Libertad.

Quick Hits:

- “A top IRS official in the division that reviews nonprofit groups will invoke the 5th Amendment and refuse to answer questions before a House committee,” reports the LA Times.

- A Senate committee approved the Gang of Eight immigration bill last night. It will go to the Senate floor after Memorial Day.

- We haven’t forgotten about Benghazi. Watch our powerful video and help us spread the word.

- Anthony Weiner, the former congressman who stepped out of public life after his lewd messages to young women were exposed, is now running for mayor of New York City.

- Have a question about the debt ceiling, Benghazi, or the IRS? Get the inside scoop today at 11:30 a.m. ET from the champions of conservatism in the U.S. House.

No comments:

Post a Comment